Code recipes

Collection of useful patterns, snippets and recipes.

When using the recipes in a notebook, don’t forget to use util.startLoop().

Fetching consecutive historical data

Suppose we want to get the 1 min bar data of Tesla since the very beginning up until now. The best way is to start with now and keep requesting further and further back in time until there is no more data returned.

import datetime

from ib_insync import *

ib = IB()

ib.connect('127.0.0.1', 7497, clientId=1)

contract = Stock('TSLA', 'SMART', 'USD')

dt = ''

barsList = []

while True:

bars = ib.reqHistoricalData(

contract,

endDateTime=dt,

durationStr='10 D',

barSizeSetting='1 min',

whatToShow='MIDPOINT',

useRTH=True,

formatDate=1)

if not bars:

break

barsList.append(bars)

dt = bars[0].date

print(dt)

# save to CSV file

allBars = [b for bars in reversed(barsList) for b in bars]

df = util.df(allBars)

df.to_csv(contract.symbol + '.csv', index=False)

Scanner data (blocking)

allParams = ib.reqScannerParameters()

print(allParams)

sub = ScannerSubscription(

instrument='FUT.US',

locationCode='FUT.GLOBEX',

scanCode='TOP_PERC_GAIN')

scanData = ib.reqScannerData(sub)

print(scanData)

Scanner data (streaming)

def onScanData(scanData):

print(scanData[0])

print(len(scanData))

sub = ScannerSubscription(

instrument='FUT.US',

locationCode='FUT.GLOBEX',

scanCode='TOP_PERC_GAIN')

scanData = ib.reqScannerSubscription(sub)

scanData.updateEvent += onScanData

ib.sleep(60)

ib.cancelScannerSubscription(scanData)

Option calculations

option = Option('EOE', '20171215', 490, 'P', 'FTA', multiplier=100)

calc = ib.calculateImpliedVolatility(

option, optionPrice=6.1, underPrice=525)

print(calc)

calc = ib.calculateOptionPrice(

option, volatility=0.14, underPrice=525)

print(calc)

Order book

eurusd = Forex('EURUSD')

ticker = ib.reqMktDepth(eurusd)

while ib.sleep(5):

print(

[d.price for d in ticker.domBids],

[d.price for d in ticker.domAsks])

Minimum price increments

usdjpy = Forex('USDJPY')

cd = ib.reqContractDetails(usdjpy)[0]

print(cd.marketRuleIds)

rules = [

ib.reqMarketRule(ruleId)

for ruleId in cd.marketRuleIds.split(',')]

print(rules)

News articles

newsProviders = ib.reqNewsProviders()

print(newsProviders)

codes = '+'.join(np.code for np in newsProviders)

amd = Stock('AMD', 'SMART', 'USD')

ib.qualifyContracts(amd)

headlines = ib.reqHistoricalNews(amd.conId, codes, '', '', 10)

latest = headlines[0]

print(latest)

article = ib.reqNewsArticle(latest.providerCode, latest.articleId)

print(article)

News bulletins

ib.reqNewsBulletins(True)

ib.sleep(5)

print(ib.newsBulletins())

WSH Event Calendar

A Wall Street Horizon subscription is needed to get corporate event data.

from ib_insync import *

ib = IB()

ib.connect('127.0.0.1', 7497, clientId=1)

# Get the conId of an instrument (IBM in this case):

ibm = Stock('IBM', 'SMART', 'USD')

ib.qualifyContracts(ibm)

print(ibm.conId) # is 8314

# Get the list of available filters and event types:

meta = ib.getWshMetaData()

print(meta)

# For IBM (with conId=8314) query the:

# - Earnings Dates (wshe_ed)

# - Board of Directors meetings (wshe_bod)

data = WshEventData(

filter = '''{

"country": "All",

"watchlist": ["8314"],

"limit_region": 10,

"limit": 10,

"wshe_ed": "true",

"wshe_bod": "true"

}''')

events = ib.getWshEventData(data)

print(events)

Dividends

contract = Stock('INTC', 'SMART', 'USD')

ticker = ib.reqMktData(contract, '456')

ib.sleep(2)

print(ticker.dividends)

Output:

Dividends(past12Months=1.2, next12Months=1.2, nextDate=datetime.date(2019, 2, 6), nextAmount=0.3)

Fundemental ratios

contract = Stock('IBM', 'SMART', 'USD')

ticker = ib.reqMktData(contract, '258')

ib.sleep(2)

print(ticker.fundamentalRatios)

Short-lived connections

This IB socket protocol is designed to be used for a long-lived connection, lasting a day or so. For short connections, where for example just a few orders are fired of, it is best to add one second of delay before closing the connection. This gives the connection some time to flush the data that has not been sent yet.

ib = IB()

ib.connect()

... # create and submit some orders

ib.sleep(1) # added delay

ib.disconnect()

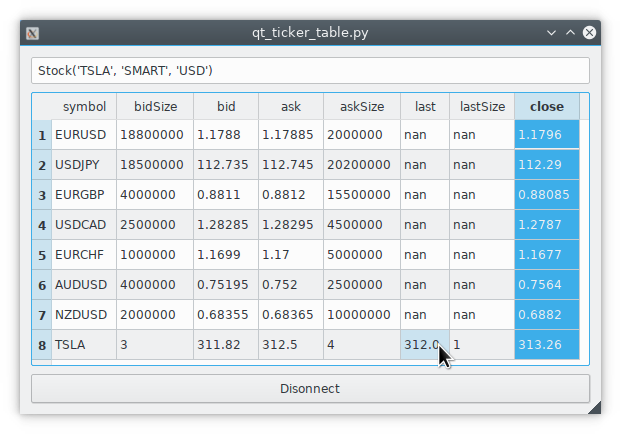

Integration with PyQt5 or PySide2

This example

of a ticker table shows how to integrate both

realtime streaming and synchronous API requests in a single-threaded

Qt application.

The API requests in this example are connect and

ib.qualifyContracts(); The latter is used

to get the conId of a contract and use that as a unique key.

The Qt interface will not freeze when a request is ongoing and it is even possible to have multiple outstanding requests at the same time.

This example depends on PyQt5:

pip3 install -U PyQt5.

It’s also possible to use PySide2 instead; To do so uncomment the PySide2

import and util.useQt lines in the example and comment out their PyQt5

counterparts.

Integration with Tkinter

To integrate with the Tkinter event loop, take a look at this example app.

Integration with PyGame

By calling ib.sleep from within the PyGame run loop, ib_insync can periodically

run for short whiles and keep up to date:

import ib_insync as ibi

import pygame

def onTicker(ticker):

screen.fill(bg_color)

text = f'bid: {ticker.bid} ask: {ticker.ask}'

quote = font.render(text, True, fg_color)

screen.blit(quote, (40, 40))

pygame.display.flip()

pygame.init()

screen = pygame.display.set_mode((800, 600))

font = pygame.font.SysFont('arial', 48)

bg_color = (255, 255, 255)

fg_color = (0, 0, 0)

ib = ibi.IB()

ib.connect()

contract = ibi.Forex('EURUSD')

ticker = ib.reqMktData(contract)

ticker.updateEvent += onTicker

running = True

while running:

# This updates IB-insync:

ib.sleep(0.03)

# This updates PyGame:

for event in pygame.event.get():

if event.type == pygame.QUIT:

running = False

pygame.quit()